20+ 2021 401k calculator

How Income Taxes Are Calculated. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return.

Early Retirement Calculator Spreadsheets Budgets Are Sexy

For instance in 2022 the 401k contribution limits rose 1000 from 2021 You start full-time employment at age 22 at a company that provides a 401k without a company match.

. For tax year 2021 these income thresholds rise to 144000 for individuals and 214000 for married couples. Enter 0 zero for one of the four and a value for each of the other three. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

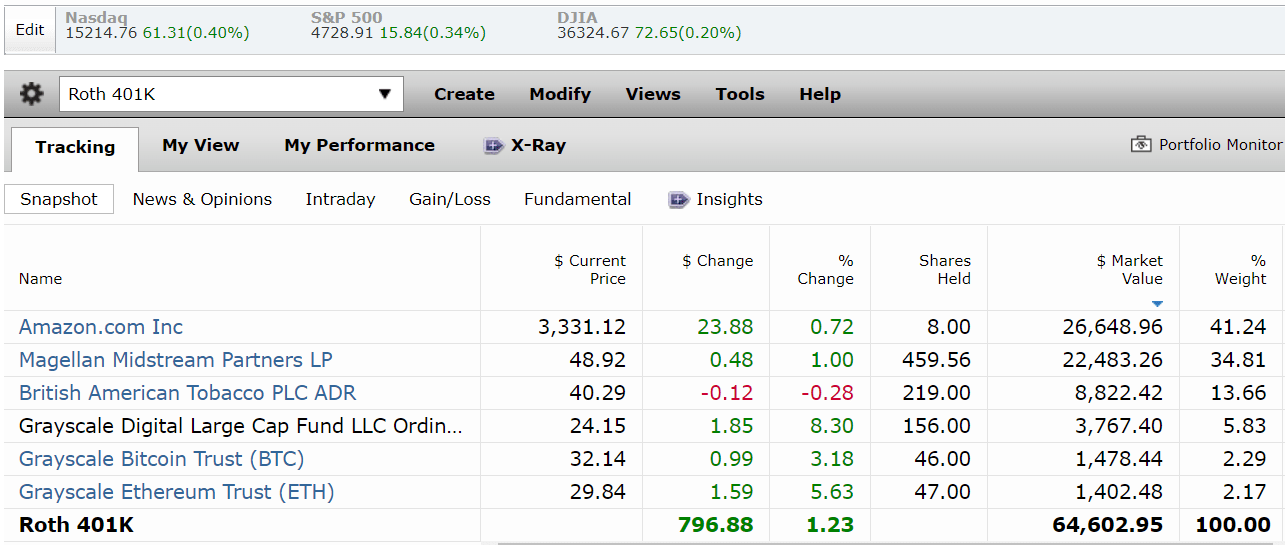

An employer contribution of 20 of your net earnings from self-employment and. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Roth 401K vs 401K Traditional IRA.

Total contributions to a participants account not counting catch-up contributions for those age 50 and over cannot exceed 61000 for 2022 57000 for 2020. The calculator has 13 inputs 4 of them are required. Understanding Self-Employment Tax.

Solutions in Focus 2022. The most you can contribute to a 401k plan is 19500 in 2021 increasing to 20500 in 2022 or 26000 in 2021 and 27000 in 2022 if youre age 50 or older. Dollar in any year from 1914 to 2022.

You might want to do so if you can easily afford to max out your contribution based on the yearly limits without it causing a large impact on your budget. ROI for retirement savings - return-on-investment. Make sure you are on track to meet your investing goals.

The state tax year is also 12 months but it differs from state to state. The 2021 deferral limit for 401k plans was 19500 the 2022 limit is. Youll pay a 0 15 or 20 tax rate depending on your taxable income.

Backward since 401k contribution limits were lower in the past. 2022 Self-Employed Tax Calculator for 2023. 401k IRA Health savings account deduction.

The long-term Capital Gains Tax rates for 2021 tax year are. The PayPal fee calculator will calculate the exact amount that PayPal charges for each business transaction. 6720 68 59500 22700 96 63 53900 222 Bryant University.

Calculates the equivalent value of the US. In this case your net earnings from self-employment is defined as your businesss profit minus the deduction for one half of. As such you get additional benefits and control compared to a large group 401k plan.

Having extra money in your pocket is just a. 2 Starting at age 59½ you can begin taking money out of your IRA without penalty but. Percent of income invested.

Year In Review 2021 Market Summary. What Is A 401K. In 2022 100 of net adjusted business profits income up to the maximum of 20500 and 27000 if age 50 or older can be contributed in salary deferrals into a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older.

Such as healthcare 401k or other financial costs and taxes are not taken from your take home pay. Mortgage Calculator Found a home you like. In a Solo 401k you play multiple roles including employee and employer.

For 2021 you can contribute up to 19500 up to 26000 if youre age 50 or older. Under certain conditions you can withdraw money from your IRA without penalty. Profit Sharing Contribution A profit sharing contribution can be made up to 20 of net adjusted businesses profits.

A catch-up contribution of for if you are 50 or older. Knowing how much your current 401k account may accumulate in the future can help you determine if you should adjust your annual 401k contributions to help reach your retirement goals. Meanwhile long-term Capital Gains Tax for crypto is lower for most taxpayers.

For 2021 your individual 401k contribution limit is 19500 or 26000 if youre age 50 or older. FAQs How Much Should You Save For Retirement. Spousal IRA A spousal IRA isnt really a special type of individual retirement account.

Solo 401ks just like other 401k plans are designed to help you save for retirement. Our 401k Growth Calculator is a simple and easy way to estimate the long-term growth of your 401k retirement account by the time you want to retire. Cashing out of your 401k is an incredibly risky choice that should only be made under extreme circumstances.

Your household income location filing status and number of personal exemptions. He deferred 19500 in regular elective deferrals plus 6500 in catch-up. Enter your total 401k retirement contributions for 2021.

Calculate your monthly payment here. You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. Try the H.

Ben age 51 earned 50000 in W-2 wages from his S Corporation in 2020. If your employer does not offer 401k loans they may still offer a 401k withdrawal. In 2022 401k contribution limits for individuals are 20500 or 27000 if youre 50.

What Is A High-Yield CD. The first is the 20 penalty you will pay to the IRS which is taken directly to cover the tax you would pay on. 202223 Tax Refund Calculator.

The Long View 2021 Business Vision. Loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Generally for a Traditional IRA distributions prior to age 59½ are subject to a 10 penalty in addition to federal and state taxes unless an exception applies. From 1914 to 2021. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Enter your IRA contributions for 2021. Inflation Calculator with US. The rules vary depending on the type of IRA you have.

The calculator will calculate any one of four unknowns. In the Solo 401k you have very high contribution limits and multiple ways to contribute. Social Security Benefits Estimator.

If you earn less than 40400 including your crypto for the 2021 tax year then youll pay no long-term Capital Gains Tax at all. Moving expenses for a job. The New HR Block Tax Calculator.

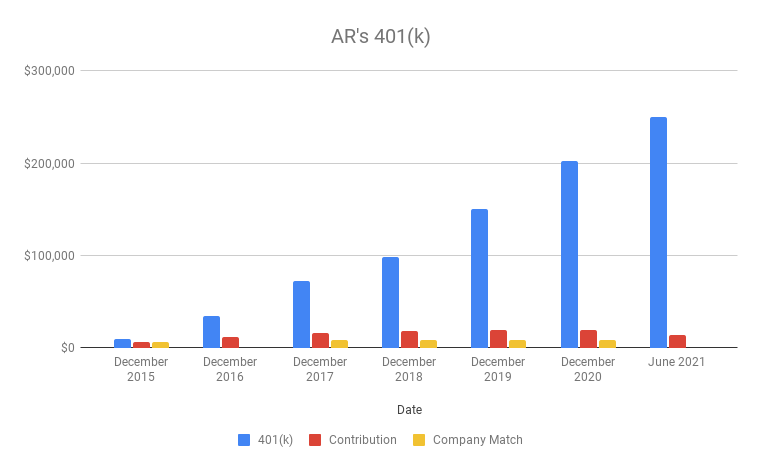

The numbers are more forward-looking vs. Tax Refund Schedule Dates 2021 2022. For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a principal residence is.

Retirement Calculator 401k Calculator eBay Fee Calculator PayPal. Calculations are based on the average annual CPI data in the US.

Early Retirement Calculator Spreadsheets Budgets Are Sexy

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

The Realistic Investment And Retirement Calculator

20 Free Retirement Calculators My Annuity Store Inc

How To Build Wealth Fast This Chart Shows What It Takes

The Realistic Investment And Retirement Calculator

Why You Should Max Out Your 401 K In Your 30s

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

3 Blue Chip Bargains I Just Bought For My 401 K And So Should You Seeking Alpha

20 Free Retirement Calculators My Annuity Store Inc

Early Retirement Calculator Spreadsheets Budgets Are Sexy

The Realistic Investment And Retirement Calculator

The Realistic Investment And Retirement Calculator

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

Retirement How To Save A Million And Live Off Dividends Seeking Alpha